Identify Team Skills Needed to Obtain the Loan

Middle Market business owners commonly delegate the administration of financing to a senior executive; for example, the CFO or COO, or experienced third-party advisor, such as the company’s attorney or CPA. That team member is tasked with leading & coordinating the financing team and activities with oversight by the owner or CEO.

Consider outlining the players on your team, their respective assignments and ongoing responsibilities, and expected timeline for the financing cycle, as illustrated below (BorrowPQ provides a template worksheet and guided interview to complete this step):

BPQ Team Template

| Area of responsibility | Business Role | Dates Needed | Comments/Notes |

| Business presentations | CEO, VP Mktg | ||

| Financials | CFO | ||

| Tax impact | CPA, 3rd party tax policy support | ||

| Valuation | CFO, 3rd party valuation services | ||

| Prospect screening | CFO | ||

| Due Diligence | CFO, COO | ||

| Agreements | CEO, CFO, Legal | ||

| Debt Servicing | CFO |

BPQ Timeline Template

| Milestone | Target Date complete | Comments/Notes |

| Phase 1 – Preparing for Borrowing | ||

| Phase 2 – Qualifying Potential Lenders | ||

| Phase 3 – Underwriting | ||

| Phase 4 – Closing and Servicing |

You will want to conduct a similar exercise once you enter into discussions with prospective lenders, to clearly identify and understand the role, timing, and responsibilities of the lender’s team.

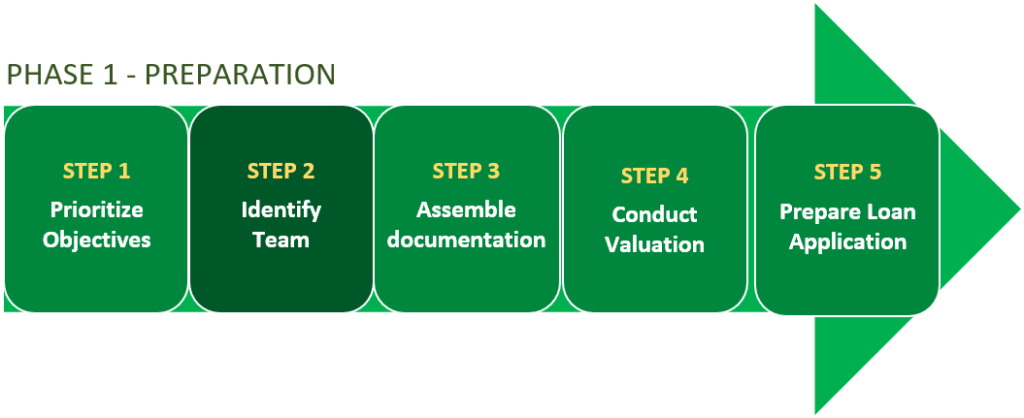

The steps involved include:

- Prioritizing the overall objective(s) including keeping restrictive covenants to a minimum as delineated in Step 1

- Setting tasks and a targeted timeline for the financing

- Allocating company staff and third-party advisors to specific tasks to ensure all needs will be addressed.

- Determining if and when “outside” assistance will be engaged, e.g.:

- Accountants to provide audited statements, financial projections or tax returns

- Tax advisors to determine outcomes with alternative loan structures

- Appraisal services – even though BorrowPQ offers a methodology for estimating the borrowing value of your assets, Lenders often want to see asset appraisals as part of the initial loan application package.

- Conducting internal due diligence to make sure all needed financial, managerial, operational, legal, intellectual property and other substantive material of interest to a potential Lender is available.

PQ can refer you to third-party advisors for Step 2 including Tax Consultants, Lawyers, Accountants and more.

Contact Us at any time for help or to provide feedback